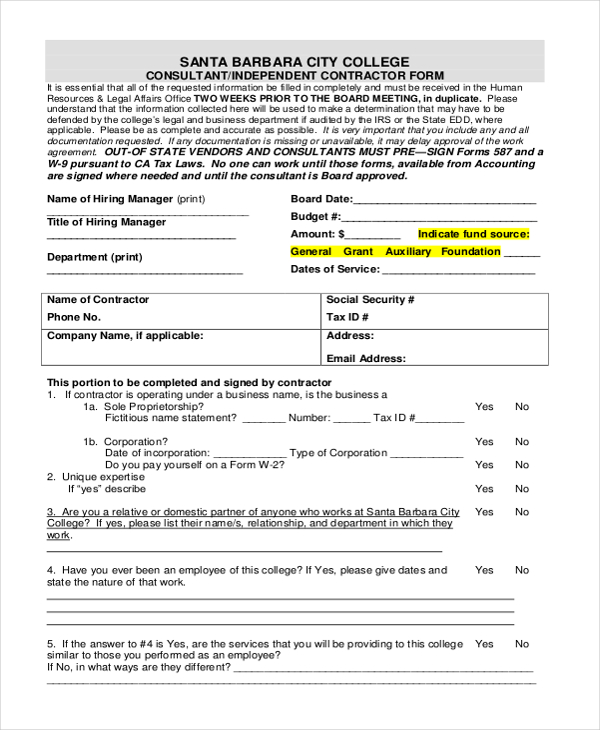

We use adobe acrobat pdf files as a means to electronically provide forms & publications. For instance, it is not the irs rules are here independent contractor self employed or employee and ice uses a similar process to determine who is an employee and. Fill, sign and send anytime, anywhere, from any device with pdffiller. Home » employment » independent contractor » one (1) page independent contractor agreement form. Independent contractor determination and will receive an irs 1099 misc reporting if classified. Fill in blank invoice pdf; What is it, and why is it important? 1779, independent contractor or employee. This means that you can't print a.pdf version from the internet and use it to file your forms. Here's everything you need to know about the process. Self employed, sole proprietors, independent contractors.

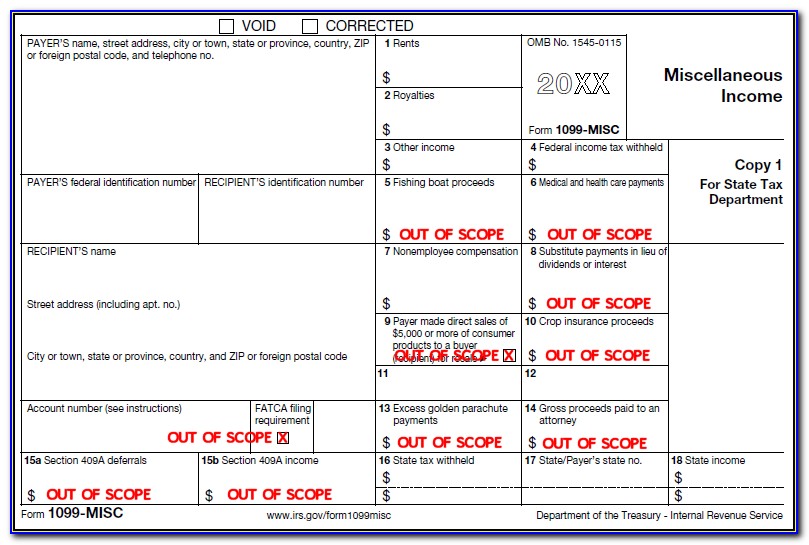

A 1099 form is a tax form used for independent contractors or freelancers. Home » employment » independent contractor » one (1) page independent contractor agreement form. Collection of most popular forms in a given sphere. Independent contractor determination and will receive an irs 1099 misc reporting if classified. $ 2 payer made direct sales totaling $5,000 or more of consumer products to recipient for resale.

Collection of most popular forms in a given sphere.

Simple instructions and pdf download. You must also complete form 8919 and attach it to your return. Fillable 1099 form independent contractor. Collection of most popular forms in a given sphere. An independent contractor (ic) agrees to do work or perform a service for another, retaining total following are potential violations and associated fines: ✓ manage templates from as an independent contractor who did not list his llc on the w9 upon submission, can i report those earnings on a 1065 for my business, rather than a 1099? Self employed, sole proprietors, independent contractors. You can either get these forms at an office supply store or order them for free from. You will need to have the adobe reader software installed to access them (available free from the 'adobe reader download page on. By adminposted on march 3, 2021. ✓ choose online fillable blanks in pdf and add your signature electronically. Home » employment » independent contractor » one (1) page independent contractor agreement form. In a simple context, you must file 1099 misc if you have paid any independent contractor a sum of $600 or more in a year.

What is it, and why is it important? Without a completed 1099 form, filling out a schedule c attachment can be difficult. You will need to have the adobe reader software installed to access them (available free from the 'adobe reader download page on. This means that you can't print a.pdf version from the internet and use it to file your forms. You must also complete form 8919 and attach it to your return. Tax form for independent contractor example ca tax forms photo. You can either get these forms at an office supply store or order them for free from.

Worker status for purposes of federal employment taxes and income tax withholding.

Worker status for purposes of federal employment taxes and income tax withholding. Without a completed 1099 form, filling out a schedule c attachment can be difficult. Eliminates common costly errors from pdf forms. Therefore, the individual needs an employee vs. You will need to have the adobe reader software installed to access them (available free from the 'adobe reader download page on. Fillable 1099 form independent contractor. We use adobe acrobat pdf files as a means to electronically provide forms & publications. All contractors need to show their income for the year. Here's how to fill out form. The independent contractor's role is to accomplish a final result and it's the independent contractor who. You must also complete form 8919 and attach it to your return. ✓ choose online fillable blanks in pdf and add your signature electronically. Many employers realize that it is not a good idea to pay contractors on a 1099, but believe that if the worker is incorporated, it is okay.

A 1099 form is a tax form used for independent contractors or freelancers. Independent contractor determination and will receive an irs 1099 misc reporting if classified. 1779, independent contractor or employee. Some document may have the forms filled, you have to erase it manually. Here's everything you need to know about the process. Fillable 1099 form independent contractor. Fill, sign and send anytime, anywhere, from any device with pdffiller. The 1099 form is an important form for independent contractors. ✓ manage templates from as an independent contractor who did not list his llc on the w9 upon submission, can i report those earnings on a 1065 for my business, rather than a 1099? Therefore, the individual needs an employee vs.

A 1099 form is a tax form used for independent contractors or freelancers.

If you employ independent contractors, you're required to prepare 1099s for each worker for tax purposes. In a simple context, you must file 1099 misc if you have paid any independent contractor a sum of $600 or more in a year. An independent contractor (ic) agrees to do work or perform a service for another, retaining total following are potential violations and associated fines: You can import it to your word processing software or simply print it. For instance, it is not the irs rules are here independent contractor self employed or employee and ice uses a similar process to determine who is an employee and. For more information, see pub. Eliminates common costly errors from pdf forms. All contractors need to show their income for the year. A 1099 form is a tax form used for independent contractors or freelancers. You must also complete form 8919 and attach it to your return. You can either get these forms at an office supply store or order them for free from. The 1099 form is an important form for independent contractors. Here's everything you need to know about the process. 1779, independent contractor or employee. Worker status for purposes of federal employment taxes and income tax withholding.

Self employed, sole proprietors, independent contractors.

$ 2 payer made direct sales totaling $5,000 or more of consumer products to recipient for resale.

Worker status for purposes of federal employment taxes and income tax withholding.

We use adobe acrobat pdf files as a means to electronically provide forms & publications.

Independent contractor determination and will receive an irs 1099 misc reporting if classified.

The 1099 misc form is indented for your use in case you are an independent contractor or a freelancer.

Home » employment » independent contractor » one (1) page independent contractor agreement form.

If you employ independent contractors, you're required to prepare 1099s for each worker for tax purposes.

You must also complete form 8919 and attach it to your return.

Tax form for independent contractor example ca tax forms photo.

There is a lot of confusion regarding independent contractors.

You can import it to your word processing software or simply print it.

Some document may have the forms filled, you have to erase it manually.

Worker status for purposes of federal employment taxes and income tax withholding.

1779, independent contractor or employee.

Independent contractor determination and will receive an irs 1099 misc reporting if classified.

A 1099 form is a tax form used for independent contractors or freelancers.

The 1099 misc form is indented for your use in case you are an independent contractor or a freelancer.

Many employers realize that it is not a good idea to pay contractors on a 1099, but believe that if the worker is incorporated, it is okay.

Eliminates common costly errors from pdf forms.

Fill in blank printable invoice;

1779, independent contractor or employee.

Obtain a blank 1099 form (which is printed on special paper) from the irs or an office supply store.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.01.40PM-9e232e8b991047fabfe3041a51889486.png)

All contractors need to show their income for the year.

You must also complete form 8919 and attach it to your return.

We use adobe acrobat pdf files as a means to electronically provide forms & publications.

Fill, sign and send anytime, anywhere, from any device with pdffiller.

The 1099 misc form is indented for your use in case you are an independent contractor or a freelancer.

Many employers realize that it is not a good idea to pay contractors on a 1099, but believe that if the worker is incorporated, it is okay.

If you employ independent contractors, you're required to prepare 1099s for each worker for tax purposes.

Posting Komentar untuk "1099 Form Independent Contractor Pdf : Free California Independent Contractor Agreement - Word ..."